A new IPO Advancer Global Limited is in town and based on what I have read so far, I believe there will be a strong demand for it. It does not help that only 2m shares at a price of $0.22 are available to the public and that works out to $440,000.

A person with deep pockets can easily sweep up all the shares but I know it cannot happen. A few bloggers shared that one should minimally apply 100,000 shares to have any significance. But why 100,000 shares? Does this give me the highest chance to get the most amount of shares?

A person with deep pockets can easily sweep up all the shares but I know it cannot happen. A few bloggers shared that one should minimally apply 100,000 shares to have any significance. But why 100,000 shares? Does this give me the highest chance to get the most amount of shares?

I decided to dig out similar IPO balloting results to find out if I can find the ‘sweet spot’.

1. Acromec Limited

27m New Shares at $0.22 each – 25.5m via placement and 1.5m shares for the public.

|

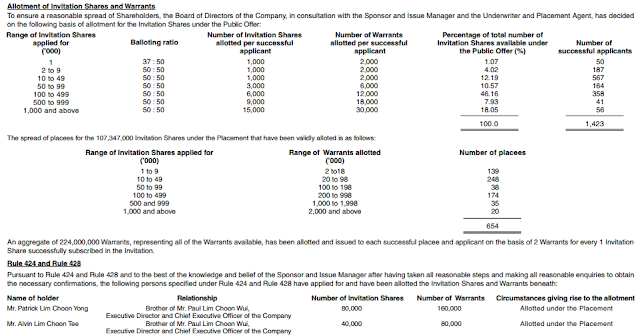

| Acromec Limited IPO Balloting Results |

2. Secura Group Limited

112m shares at $0.25 each – 108m shares via placement and 4m shares for the public.

|

| Secura Group Limited IPO Balloting Results |

3. Jumbo Group Limited

88.23m new shares at $0.25 each – 86.23m via placement and 2m shares for the public.

|

| Jumbo Group Limited IPO Balloting Results |

4. CMC Infocomm Limited

24m new shares at $0.25 each – 21.6m via placement and 2.4m shares for the public.

|

| CMC Infocomm Limited IPO Balloting Results |

5. Choo Chiang Holdings Ltd.

33.28m new shares at $0.35 each – 32.28m via placement and 1m shares for the public.

|

| Choo Chiang Holdings Limited Balloting Results |

6. NauticAWT Limited

28m new shares at $0.20 each – 27m via placement and 1m shares for the public.

|

| NauticAWT Limited IPO Balloting Results |

7. Singapore O&G Ltd

43.6m new shares at $0.25 each – 41.4m via placement and 2.2m shares for the public

|

| Singapore O&G Limited IPO Balloting Results |

Balloting Results Image credit: Singapore IPOs and A Path to Forever Financial Freedom (3Fs)

To find the sweet spot, I looked at the following metrics:

Range of offered shares (‘000)

1

2 to 9

10 to 49

50 to 99

100 to 499

500 to 999

1,000 and above

2 to 9

10 to 49

50 to 99

100 to 499

500 to 999

1,000 and above

Except for subtle difference in Acromec and Jumbo, all the IPOs fall within the above range. This is important as I now know that I should apply in dominators of 10, 50, 100, 500 or 1,000 lots.

Highest Balloting Ratio

IPO with a Positive relationship between balloting ratio and number of shares applied: Jumbo Group Limited, Choo Chiang Holdings Ltd., NauticAWT Limited

IPO with a Negative relationship between balloting ratio and number of shares applied: Singapore O&G Ltd

IPO with a fix balloting ratio after the 1st lot: Acromec Limited, Secura Group Limited

CMC Infocomm Limited is the odd one out. The balloting ratio drops as the number of shares applied for increases and increases again.

Although there is no clear winner here, we must consider the fact that the share price is very low. Unless I am expecting the share to become a multi-bagger, getting a 1 to 2 lots will not get me very far.

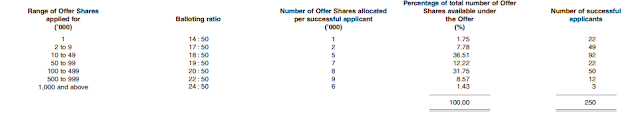

Number of Offer Shares allocated per successful applicant

This is where it gets interesting.

|

| Number of Offer Shares allocated per successful applicant |

Based on the results above. It is not difficult to figure out that 100 lots gives you the most bang for buck. Apart from Jumbo and Singapore O&G, applying for an additional 400 lots increases the number of shares allocated by a maximum of just 3 lots.

Percentage of total number of Offer Shares available to the public

The highest percentage of shares available to the public are always in the “10 to 49” and “100 to 499” range.

Number of successful applicants

Although this does not help in determining the number of shares that I should apply, it does helps me find out how many people I am up against. Except for Secura with 1,400+ successful applicants, the rest of the IPOs have about 100 to 500 successful applicants. Unsurprisingly, the most number of applicants are in the “10 to 49” and “100 to 499” range.

The IPOs that I have dug out were from 2015 onwards. The IPO price range from $0.20 to $0.35 and the public shares available range from 1m to 4m. If Advancer Global is to follow the past trend, 100 lots is indeed the sweet spot followed by 10 lots.

Good Luck in your IPO application. thefinance.sg

Blogger Comment

Facebook Comment